21 改进的GARCH模型

本章讲GARCH模型的一些有针对性的改进。 来自(Tsay 2013)§4.9-4.11内容。

21.1 EGARCH模型

21.1.1 模型

(Nelson 1991)提出的指数GARCH(EGARCH)模型允许正负资产收益率对波动率有不对称的影响。 考虑如下变换 \[\begin{align} g(\varepsilon_t) = \alpha\varepsilon_t + \gamma\left[ |\varepsilon_t| - E|\varepsilon_t| \right] , \tag{21.1} \end{align}\] 其中\(\alpha\)和\(\gamma\)是实常数。 \(\{\varepsilon_t \}\)和\(\{ |\varepsilon_t| - E|\varepsilon_t| \}\)都分别是零均值独立同分布白噪声, 分布为连续分布。 易见\(Eg(\varepsilon_t)=0\)。

\(g(\varepsilon_t)\)关于正的\(\varepsilon_t\)和负的\(\varepsilon_t\)结果不同, 对于绝对值相等但符号相反的\(\varepsilon_t\), 设\(\alpha < 0\), 则负的\(\varepsilon_t\)对应的\(g(\varepsilon_t)\)更大, 而正的\(\varepsilon_t\)对应的\(g(\varepsilon_t)\)更小。

当\(\varepsilon_t \sim \text{N}(0,1)\)时\(E|\varepsilon_t| = \sqrt{\frac{2}{\pi}}\)。 对式(19.6)中的标准t分布,有 \[ E|\varepsilon_t| = \frac{2 \sqrt{v-2} \Gamma(\frac{v+1}{2})}{ (v-1)\Gamma(\frac{v}{2}) \sqrt{\pi}} . \]

EGARCH(\(m,s\))模型可以用滞后算子的形式写成

\[\begin{align} a_t = \sigma_t \varepsilon_t, \quad \ln\sigma_t^2 = \alpha_0' + \frac{1 + \alpha_2 B + \dots + \alpha_m B^{m-1}}{ 1 - \beta_1 B - \dots - \beta_s B^s} g(\varepsilon_{t-1}) \tag{21.2} \end{align}\] \(\alpha_0'\)为常数, 其中\(B\)是滞后算子, 多项式\(1 + \alpha_2 z + \dots + \alpha_m z^{m-1}\)和 \(1 - \beta_1 z - \dots - \beta_m z^m\)的根都在单位圆外且两个多项式没有公因子。

注意这里的模型阶相当于GARCH(\(m,s\))。 EGARCH(\(1,1,\))模型为 \[ \ln\sigma_t^2 = \alpha_0 + \alpha \varepsilon_{t-1} + \gamma[|\varepsilon_{t-1}| - E|\varepsilon_{t-1}|] + \beta \ln\sigma_{t-1}^2 . \]

记\(\xi_t = \ln\sigma_t^2\), 则(21.2)给出的\(\xi_t\)为一个平稳线性ARMA\((s, m-1)\)序列, 以零均值独立同分布白噪声\(g(\varepsilon_{t-1})\)为新息; 但是, \(\ln\sigma_t^2\)通过\(\varepsilon_{t-j} = a_{t-j} / \sigma_{t-j}\)对\(\{ a_t \}\)序列依赖。 原始的GARCH模型的\(\sigma_t^2\)的方程是直接依赖于\(a_{t-j}^2\)的,\(\pm a_{t-j}\)对\(\sigma_t^2\)影响相同。

易见\(E\ln\sigma_t^2 = \alpha_0'\)。

EGARCH(\(m,s\))模型展开后可以写成

\[\begin{align} a_t =& \sigma_t \varepsilon_t, \\ \ln\sigma_t^2 =& \alpha_0 + \sum_{j=1}^m \left[\alpha_j \varepsilon_{t-j} + \gamma_j(|\varepsilon_{t-j}| - E |\varepsilon_{t-j}|) \right] + \sum_{i=1}^s \beta_i \ln \sigma_{t-i}^2 . \tag{21.3} \end{align}\]

在(21.3)中, \(\alpha_j\)代表了对数收益率的正负扰动对波动率的不同影响, 如果\(\alpha_j=0\), 则正负扰动对波动率影响就相同了。

EGARCH与GARCH模型的区别还有:

- 使用条件方差的对数建模, 因为对数值可正可负, 这就取消了GARCH模型对系数必须非负的限制。

- \(g(\varepsilon_{t-j})=g(a_{t-j}/\sigma_{t-j})\)的使用使得波动率对\(a_{t-j}\)的依赖关系与\(a_{t-j}\)的正负号有关, 可以用来描述正负收益率对波动率的不同的影响, 即杠杆效应。

21.1.2 EGARCH(1,1)模型

以最简单的EGARCH(1,1)为例来讨论。 模型为

\[\begin{align} a_t =& \sigma_t \varepsilon_t, \\ \ln \sigma_t^2 =& \alpha_0 + \left[ \alpha_1 \varepsilon_{t-1} + \gamma_1 (|\varepsilon_{t-1}| - E|\varepsilon_{t-1}|) \right] + \beta_1 \ln\sigma_{t-1}^2 . \tag{21.4} \end{align}\]

其中\(\varepsilon_t\) iid N(0,1), 这个模型的阶类似GARCH(1,1), 模型实际上是关于\(\ln \sigma_t^2\)的一个AR(1)模型。

与一个GARCH(1,1)模型对比: \[\begin{aligned} \sigma_t^2 = \alpha_0 + \alpha_1 a_{t-1}^2 + \beta_1 \sigma_{t-1}^2 \end{aligned}\] 所以EGARCH模型用\(\ln\sigma_t^2\)替换了\(\sigma_t^2\), 用\(g(\varepsilon_{t-1})\)替换了\(\alpha_1 a_{t-1}^2\), 用\(\ln\sigma_{t-1}^2\)替换了\(\sigma_{t-1}^2\)。 注意\(g(\varepsilon_{t-1}) = g(a_{t-1} / \sigma_{t-1})\)。

(21.4)中, 设\(\alpha_1 < 0\), \(\varepsilon_{t-1} \geq 0\)时, \(\ln\sigma_t^2\)变小, \(\varepsilon_{t-1} < 0\)时, \(\ln\sigma_t^2\)变大, 对于相同的\(|a_{t-1}|\), 负值比正值产生更大的\(\ln\sigma_t^2\)。

波动率方程可以写成 \[\begin{aligned} \sigma_t^2 =\sigma_{t-1}^{2\beta_1} e^{\alpha_0''} \cdot \begin{cases} \exp\left[ (\gamma_1 + \alpha_1) \frac{|a_{t-1}|}{\sigma_{t-1}} \right], & a_{t-1} \geq 0 \\ \exp\left[ (\gamma_1 - \alpha_1) \frac{|a_{t-1}|}{\sigma_{t-1}} \right], & a_{t-1} < 0 \end{cases} \end{aligned}\] 其中\(\alpha_0'' = \alpha_0 - \gamma_1 E|\varepsilon_{t-1}|\)。

系数\(\gamma_1 + \alpha_1\)和\(\gamma_1 - \alpha_1\)表明当\(\alpha_1\neq 0\) 时模型对正的和负的\(a_{t-1}\)的响应是非对称的, 由于一般负的扰动造成的波动更大, 所以\(\alpha_1\)应该是负的才比较符合实际数据。

21.1.3 实例1:CRSP价值加权指数超额收益率

例子来自(Nelson 1991)的文章。 考虑CRSP价值加权指数的超额收益率日数据, 从1962年7月到1987年12月,共6408个观测值, 超额收益率是价值加权指数的收益率减去国债的月收益率, 假定一个月每天的国债收益率相等。

用\(r_t\)表示超额收益率, 所用的模型为

\[\begin{aligned} r_t =& \phi_0 + \phi_1 r_{t-1} + c\sigma_{t}^2 + a_t, \quad a_t = \sigma_t \varepsilon_t,\\ \ln\sigma_t^2 =& \alpha_0 + \ln(1 + \omega N_t) + \frac{1 + \beta B}{1 - \alpha_1 B - \alpha_2 B^2} g(\varepsilon_{t-1}), \\ g(\varepsilon_{t-1}) =& \theta \varepsilon_{t-1} + \gamma (|\varepsilon_{t-1}| - E|\varepsilon_{t-1}|) . \end{aligned}\] 均值方程是带有回归自变量的AR(1)模型, 回归自变量是波动率平方, 这个回归自变量代表了风险溢价, \(c\)是风险溢价参数。 波动率方程中的回归自变量\(N_t\)是第\(t-1\)交易日到第\(t\)交易日之间没有交易的天数, 这一项解释了放假休市若干天以后增加的波动。 \(\varepsilon_t\)使用广义误差分布(GED), 波动率方程是是EGARCH(2,2)模型。 这里所用的符号与21.1.1有所不同。 \(\theta\)代表了杠杆效应。

(Nelson 1991)论文中参数估计值与标准误差列表如下:

\[ \begin{array}{crr} \text{参数} & \text{估计值} & \text{标准误差} \\ \hline \alpha_0 & -10.06 & 0.346 \\ \omega & 0.183 & 0.028 \\ \gamma & 0.156 & 0.023 \\ \alpha_1 & 1.929 & 0.015 \\ \alpha_2 & -0.929 & 0.015 \\ \beta & -0.978 & 0.006 \\ \theta & -0.118 & 0.009 \\ \phi_0 & 3.5 \times 10^{-4} & 9.9\times 10^{-5} \\ \phi_1 & 0.205 & 0.012 \\ c & -3.361 & 2.026 \\ v & 1.576 & 0.032 \end{array} \]

估计中只有风险溢价参数\(c\)是不显著, 其它参数, 包括代表了不对称性的\(\theta\),都是显著的, \(\theta\)估计为负, 这表明模型的波动率收到负的扰动影响更大。

21.1.4 实例2:IBM股票月对数收益率

考虑IBM股票月对数收益率建模, 从1967年1月到2009年12月, 561个观测值。 建立EGARCH(1,1)模型, 使用(21.4)的模型形式, 模型为 \[\begin{aligned} r_t =& \mu + a_t, \\ a_t =& \sigma_t \varepsilon_t, \\ \ln \sigma_t^2 =& \alpha_0 + \left[ \alpha_1 \varepsilon_{t-1} + \gamma_1 (|\varepsilon_{t-1}| - E|\varepsilon_{t-1}|) \right] + \beta_1 \ln\sigma_{t-1}^2 . \end{aligned}\]

读入数据:

da <- read_table(

"m-ibmsp6709.txt",

col_types=cols(

.default=col_double(),

date=col_date(format="%Y%m%d")))

xts.ibm <- xts(log(1 + da[["ibm"]]), da[["date"]])

tclass(xts.ibm) <- "yearmon"

ts.ibm <- ts(log(1 + da[["ibm"]]),

start=c(1967,1), frequency=12)对数收益率的时间序列图:

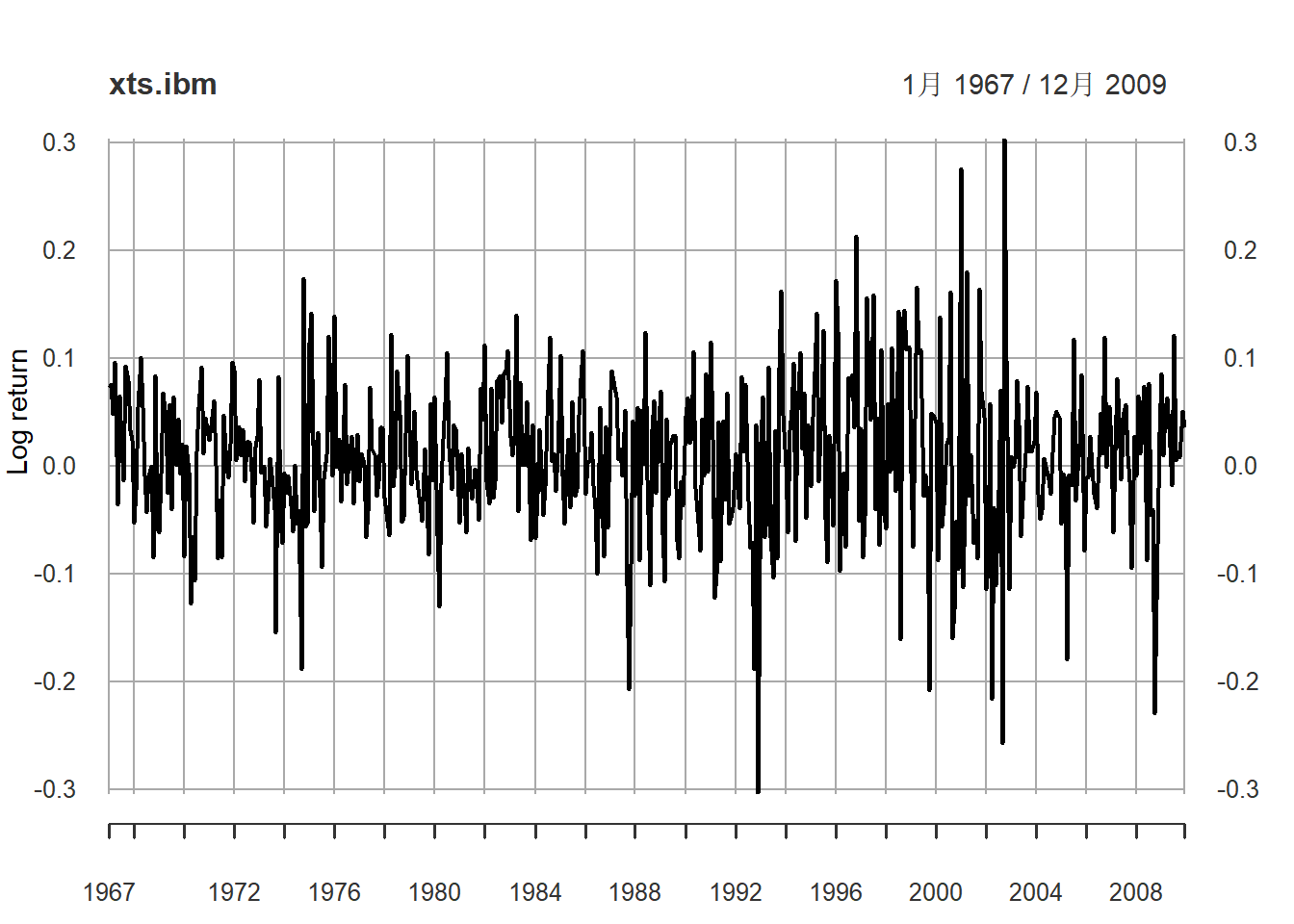

图21.1: IBM股票月对数收益率

ACF图:

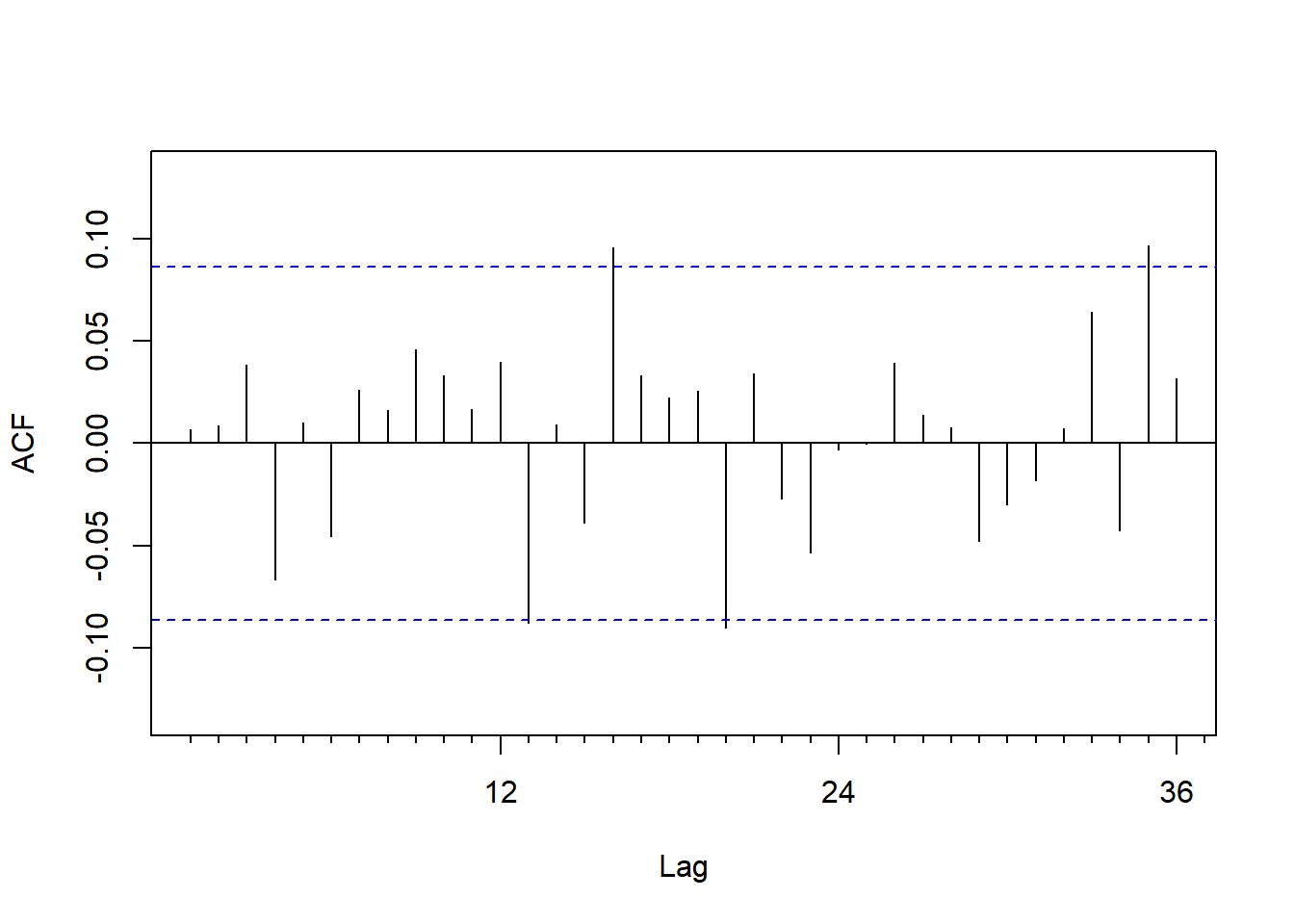

图21.2: IBM股票月对数收益率ACF

从对数收益率的ACF来看基本是白噪声。作Ljung-Box白噪声检验:

##

## Box-Ljung test

##

## data: xts.ibm

## X-squared = 7.4042, df = 12, p-value = 0.8298基本可以认为是(宽)白噪声。

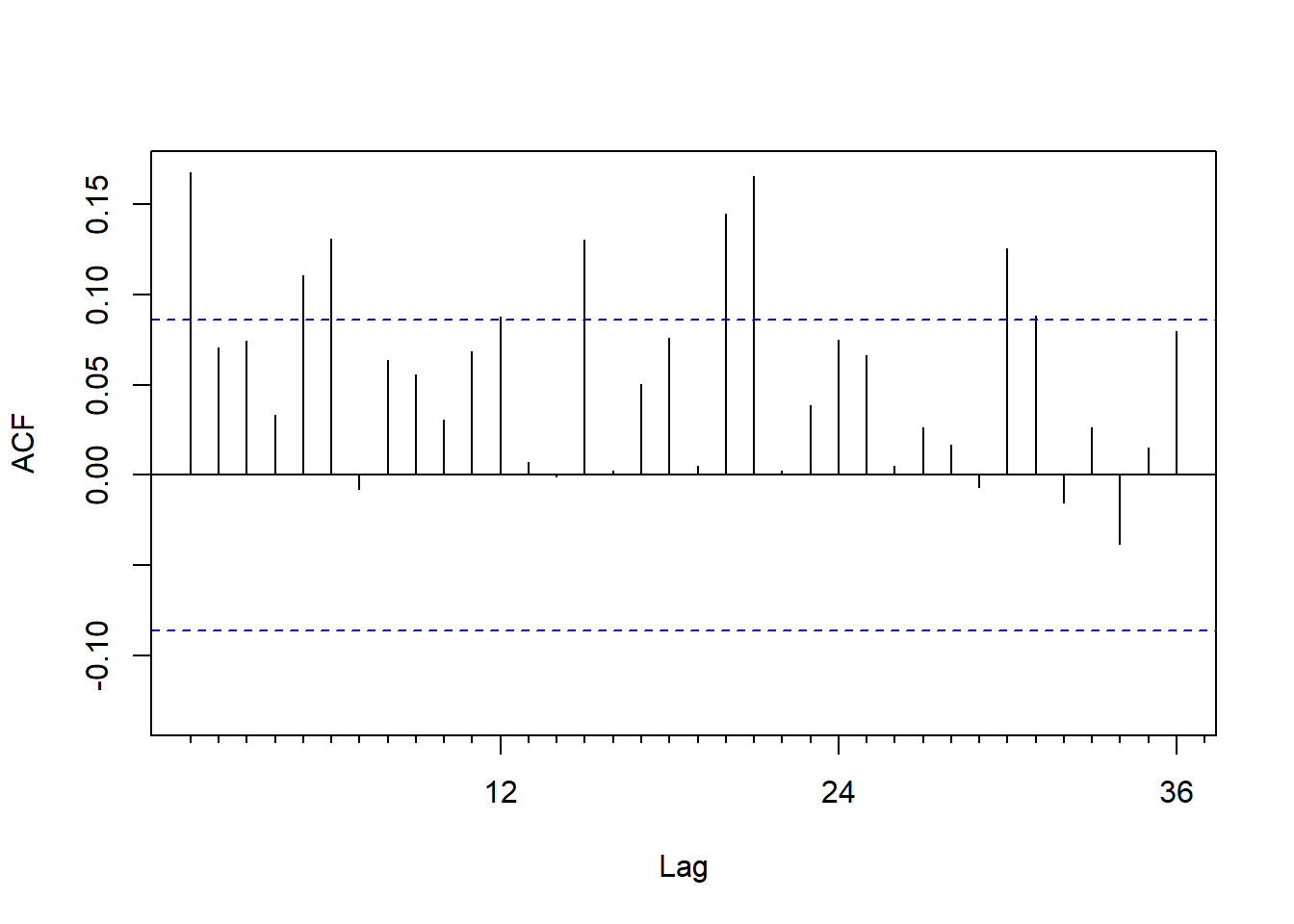

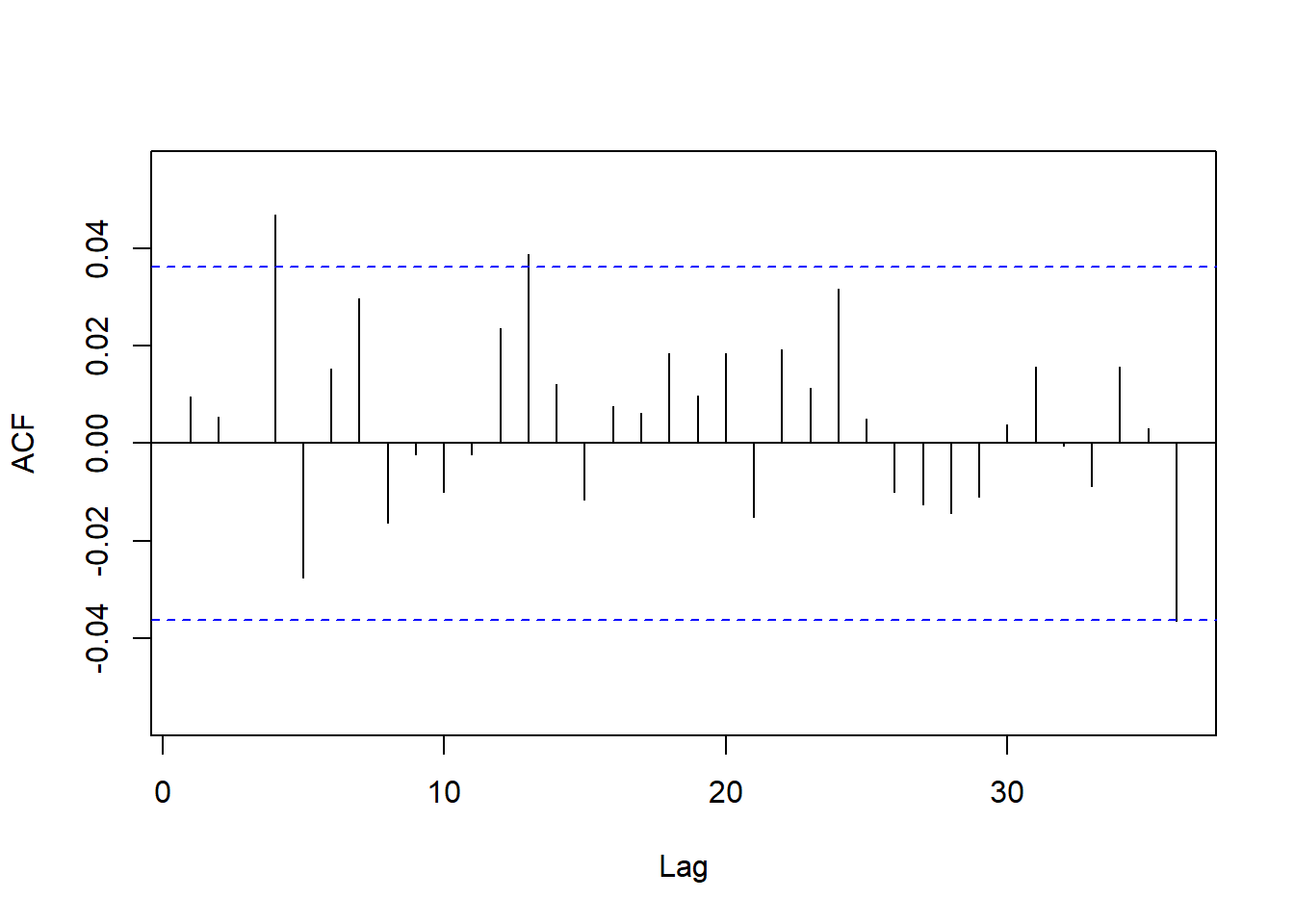

\(a_t^2\)的ACF:

图21.3: IBM股票月对数收益率平方ACF

这表明有轻微的ARCH效应。

用rugarch扩展包可以估计EGARCH模型,程序如:

## Loading required package: parallel##

## Attaching package: 'rugarch'## The following object is masked from 'package:purrr':

##

## reduce## The following object is masked from 'package:stats':

##

## sigmaspec1 <- ugarchspec(

mean.model = list(

armaOrder=c(0,0),

include.mean=TRUE ),

variance.model = list(

model = "eGARCH", # exponential GARCH model

garchOrder = c(1,1) ) )

mod1ru <- ugarchfit(spec = spec1, data = xts.ibm)

show(mod1ru)##

## *---------------------------------*

## * GARCH Model Fit *

## *---------------------------------*

##

## Conditional Variance Dynamics

## -----------------------------------

## GARCH Model : eGARCH(1,1)

## Mean Model : ARFIMA(0,0,0)

## Distribution : norm

##

## Optimal Parameters

## ------------------------------------

## Estimate Std. Error t value Pr(>|t|)

## mu 0.006649 0.002963 2.2442 0.024820

## omega -0.423208 0.223673 -1.8921 0.058480

## alpha1 -0.094813 0.039373 -2.4081 0.016037

## beta1 0.920485 0.041729 22.0586 0.000000

## gamma1 0.218711 0.060802 3.5971 0.000322

##

## Robust Standard Errors:

## Estimate Std. Error t value Pr(>|t|)

## mu 0.006649 0.003073 2.1635 0.030502

## omega -0.423208 0.308230 -1.3730 0.169743

## alpha1 -0.094813 0.051835 -1.8291 0.067382

## beta1 0.920485 0.057270 16.0728 0.000000

## gamma1 0.218711 0.061770 3.5407 0.000399

##

## LogLikelihood : 651.634

##

## Information Criteria

## ------------------------------------

##

## Akaike -2.5063

## Bayes -2.4652

## Shibata -2.5065

## Hannan-Quinn -2.4902

##

## Weighted Ljung-Box Test on Standardized Residuals

## ------------------------------------

## statistic p-value

## Lag[1] 1.237 0.2661

## Lag[2*(p+q)+(p+q)-1][2] 1.344 0.3989

## Lag[4*(p+q)+(p+q)-1][5] 1.867 0.6501

## d.o.f=0

## H0 : No serial correlation

##

## Weighted Ljung-Box Test on Standardized Squared Residuals

## ------------------------------------

## statistic p-value

## Lag[1] 0.009633 0.9218

## Lag[2*(p+q)+(p+q)-1][5] 1.087446 0.8396

## Lag[4*(p+q)+(p+q)-1][9] 2.511467 0.8360

## d.o.f=2

##

## Weighted ARCH LM Tests

## ------------------------------------

## Statistic Shape Scale P-Value

## ARCH Lag[3] 0.09128 0.500 2.000 0.7626

## ARCH Lag[5] 1.10479 1.440 1.667 0.7021

## ARCH Lag[7] 2.20197 2.315 1.543 0.6746

##

## Nyblom stability test

## ------------------------------------

## Joint Statistic: 1.1719

## Individual Statistics:

## mu 0.21948

## omega 0.61756

## alpha1 0.15868

## beta1 0.61824

## gamma1 0.06386

##

## Asymptotic Critical Values (10% 5% 1%)

## Joint Statistic: 1.28 1.47 1.88

## Individual Statistic: 0.35 0.47 0.75

##

## Sign Bias Test

## ------------------------------------

## t-value prob sig

## Sign Bias 0.1014 0.9192

## Negative Sign Bias 0.2560 0.7980

## Positive Sign Bias 0.1888 0.8503

## Joint Effect 0.3726 0.9458

##

##

## Adjusted Pearson Goodness-of-Fit Test:

## ------------------------------------

## group statistic p-value(g-1)

## 1 20 13.07 0.8350

## 2 30 22.26 0.8094

## 3 40 28.03 0.9040

## 4 50 42.53 0.7314

##

##

## Elapsed time : 0.0812149估计的模型可以写成:

\[\begin{aligned} r_t =& 0.0066 + a_t, \quad a_t = \sigma_t \varepsilon_t, \quad \varepsilon_t \text{ iid N}(0,1) \\ \ln\sigma_t^2 =& -0.4232 - 0.0948 \varepsilon_{t-1} + 0.2187(|\varepsilon_{t-1}| - E|\varepsilon_{t-1}|) + 0.9205 \ln\sigma_{t-1}^2 . \end{aligned}\] 这种模型是关于\(\{ \ln\sigma_t^2 \}\)的一个AR(1)模型。 输出中参数alpha1代表了正负收益率对波动率不对称影响的杠杆效应, 在0.05水平下这一项显著, 说明杠杆效存在。

取\(\varepsilon_{t-1}=\pm 2\)时, 不同正负号的\(\varepsilon_{t-1}\)引起的\(\sigma_t^2\)的变化比值为 \[ e^{4 \times 0.0948} = 1.46, \] 所以这时幅度相等的负的扰动比正的扰动额外增加46%的波动率平方。 幅度越大,额外增加的波动率也越大。

计算标准化残差\(\tilde a_t = a_t/\sigma_t\)和波动率\(\sigma_t\):

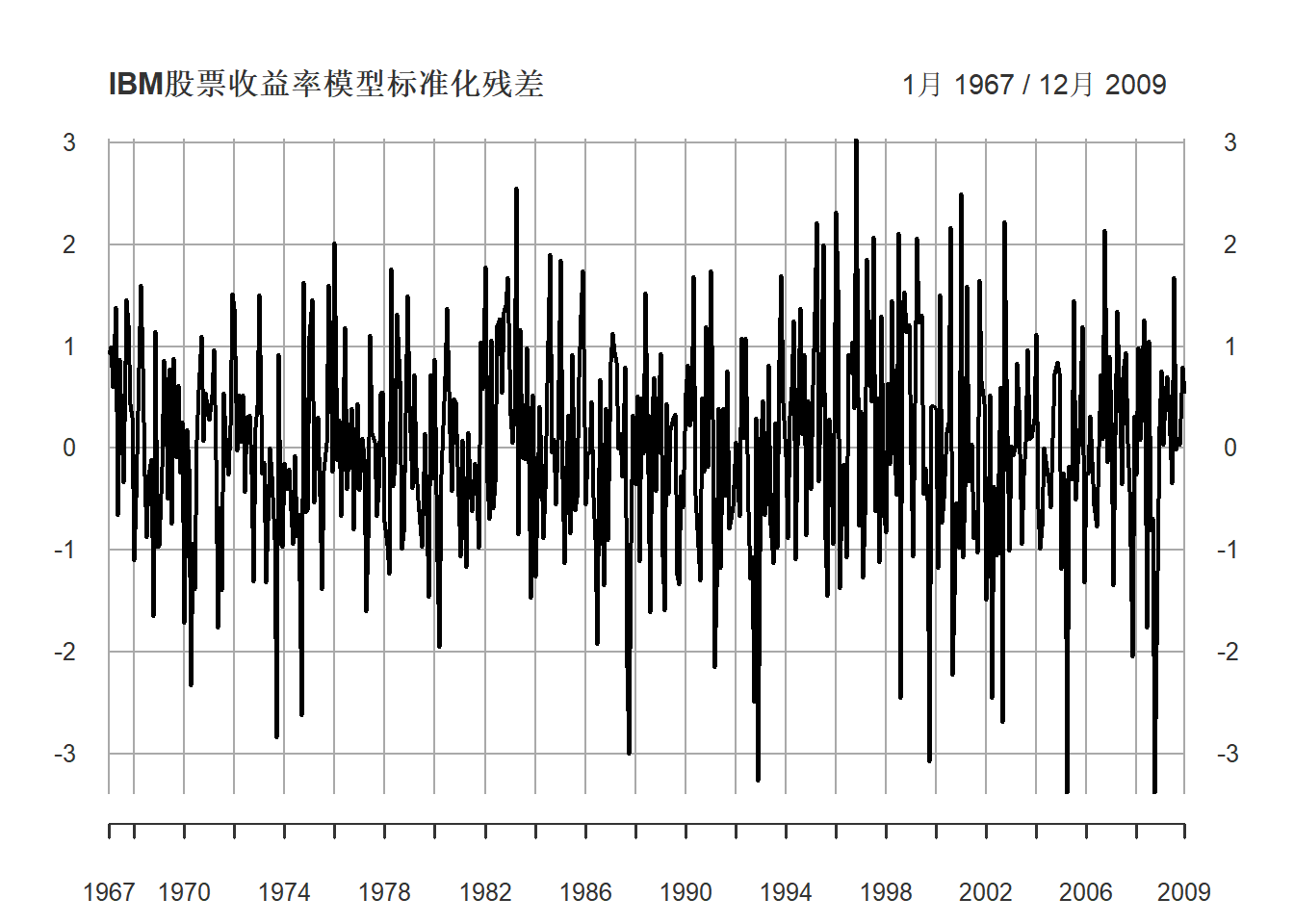

标准化残差图:

图21.4: IBM股票收益率模型标准化残差

估计的波动率:

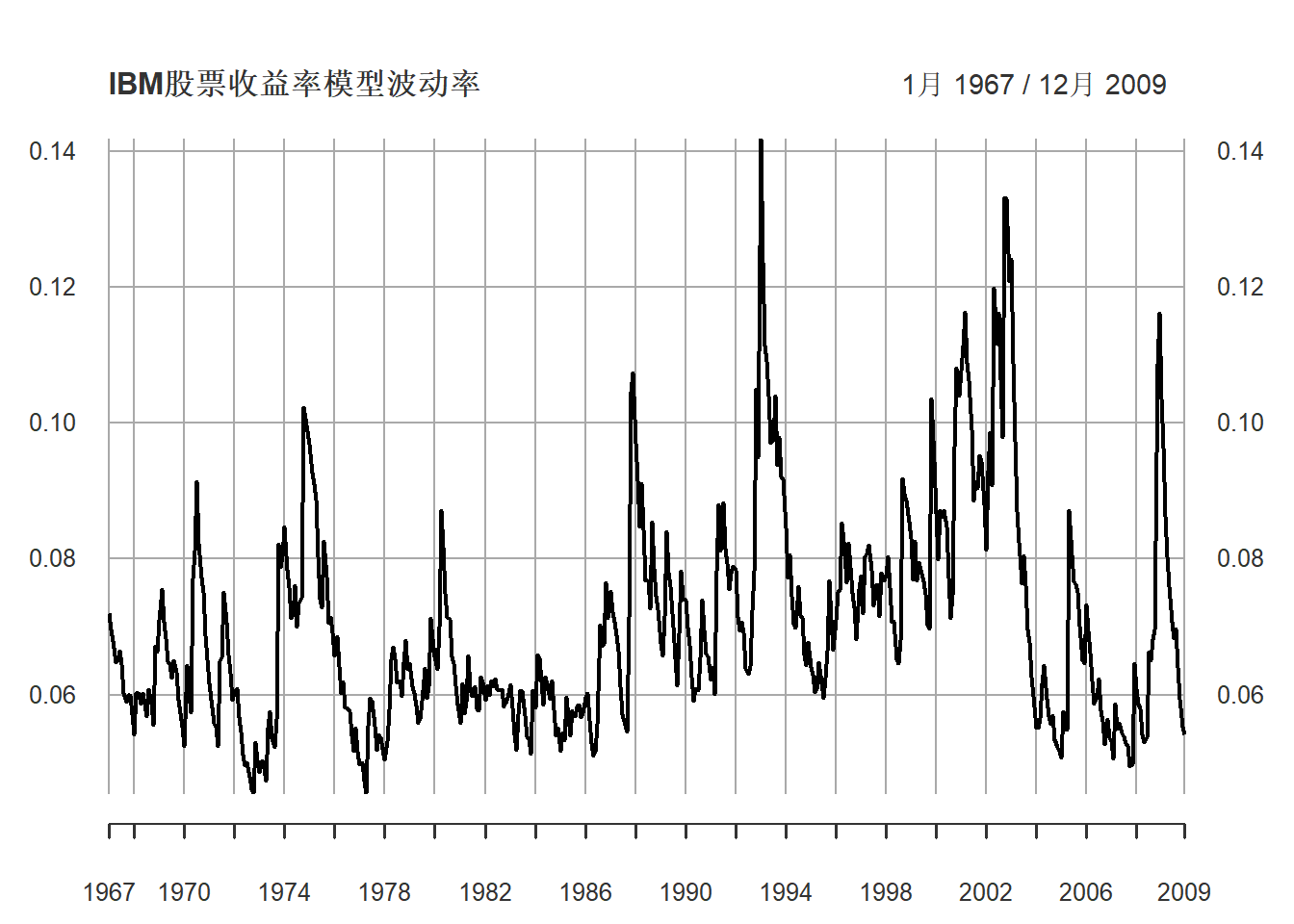

图21.5: IBM股票收益率模型波动率

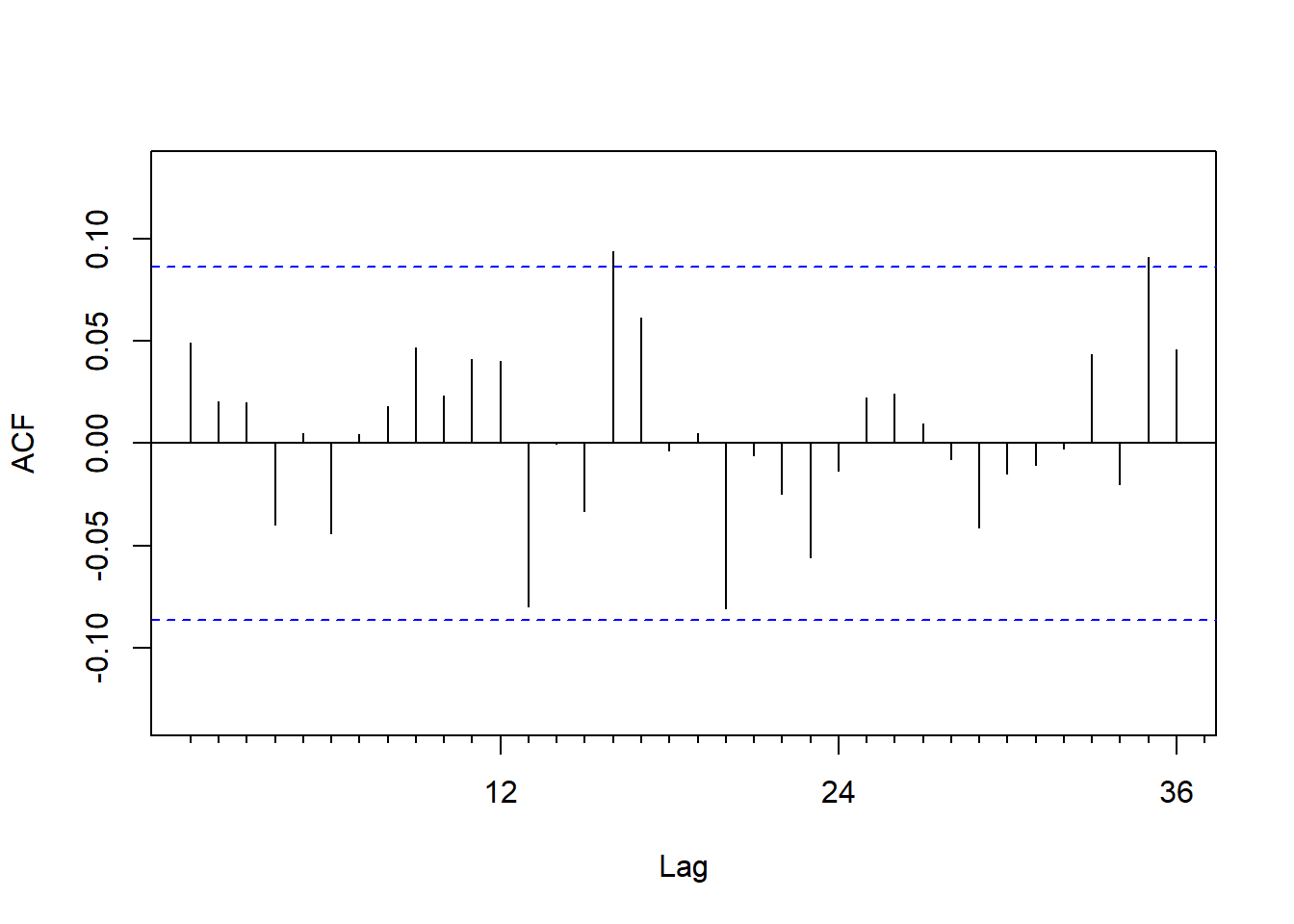

标准化残差的ACF:

图21.6: IBM股票收益率模型标准化残差ACF

标准化残差的Ljung-Box白噪声检验:

##

## Box-Ljung test

##

## data: stdresi

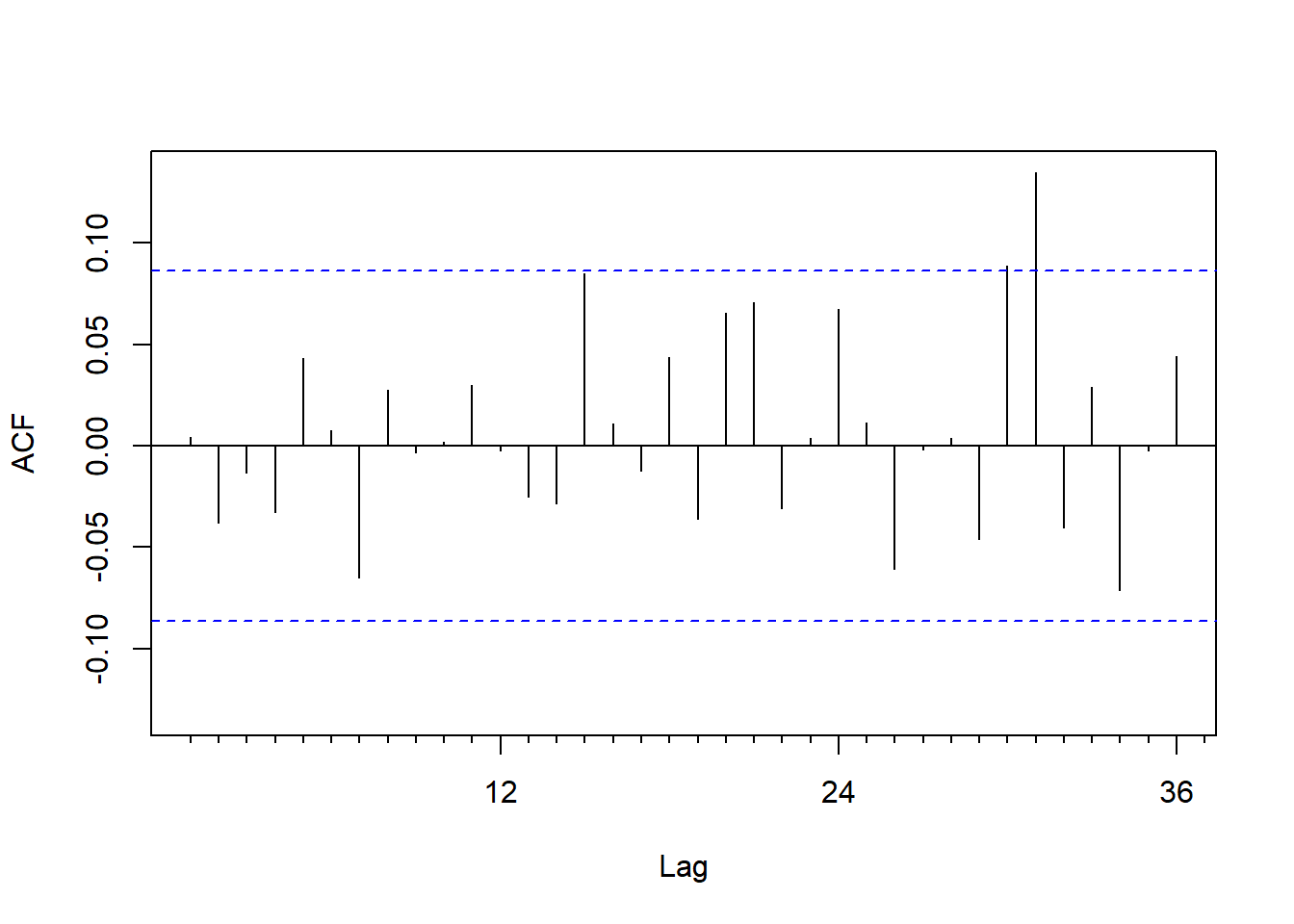

## X-squared = 6.894, df = 12, p-value = 0.8645标准化残差平方的ACF:

图21.7: IBM股票收益率模型标准化残差平方的ACF

标准化残差平方的Ljung-Box白噪声检验:

##

## Box-Ljung test

##

## data: stdresi^2

## X-squared = 5.537, df = 12, p-value = 0.9376从以上残差诊断看模型比较充分。

从ugarchfit()的结果看,

标准化残差及其残差的白噪声检验通过,

分布的拟合优度检验通过,

模型参数稳定性检验通过,

杠杆效应的检验通过。

21.1.5 预测

以EGARCH(1,1)为例说明EGARCH模型的超前多步预测。 设模型参数已知, \(\varepsilon_t\)服从标准正态分布。 模型为(见(21.4)、(21.1)) \[\begin{aligned} \ln\sigma_t^2 =& \alpha_0 + \beta_1 \ln\sigma_{t-1}^2 + \alpha_1 \varepsilon_{t-1} + \gamma_1(|\varepsilon_{t-1}| - E|\varepsilon_{t-1}| ) . \end{aligned}\] 其中\(E|\varepsilon_{t-1}| = \sqrt{\frac{2}{\pi}}\)。 记 \[ g(x) = \alpha_1 x + \gamma_1(|x| - \sqrt{\frac{2}{\pi}}), \] 则模型可以写成 \[ \ln\sigma_t^2 = \alpha_0 + \beta_1 \ln\sigma_{t-1}^2 + g(\varepsilon_{t-1}), \] 将模型写成指数形式为 \[\begin{aligned} \sigma_t^2 = e^{\alpha_0} \sigma_{t-1}^{2\beta_1} e^{g(\varepsilon_{t-1})} . \end{aligned}\]

以\(h\)为预测原点, 超前一步预测是对\(\sigma_{h+1}^2\)的预测,而 \[\begin{aligned} \sigma_{h+1}^2 = e^{\alpha_0} \sigma_{h}^{2\beta_1} e^{g(\varepsilon_{h})} \in F_h , \end{aligned}\] 所以超前一步预测为 \[\begin{align} \hat\sigma_h^2(1) = E(\sigma_{h+1}^2 | F_h) = \sigma_{h+1}^2 . \tag{21.5} \end{align}\]

对\(t=h+2\), \[\begin{aligned} \sigma_{h+2}^2 = e^{\alpha_0} \sigma_{h+1}^{2\beta_1} e^{g(\varepsilon_{h+1})} , \end{aligned}\] 注意到\(\sigma_{h+1}^2 \in F_h\),\(\varepsilon_{h+1}\)与\(F_h\)独立,所以有 \[\begin{aligned} \hat\sigma_h^2(2) =& E(\sigma_{h+2}^2 | F_h) = e^{\alpha_0} \sigma_{h+1}^{2\beta_1} E[e^{g(\varepsilon_{h+1})} | F_h] \\ =& e^{\alpha_0} \sigma_{h+1}^{2\beta_1} E[e^{g(\varepsilon_{h+1})}] . \end{aligned}\]

只需要计算\(E[e^{g(\varepsilon_{h+1})}]\)。 设\(\varepsilon \sim \text{N}(0,1)\),则 \[\begin{aligned} E e^{g(\varepsilon)} =& \int_{-\infty}^\infty \exp\left\{ \alpha_1 u + \gamma_1 |u| - \gamma_1 \sqrt{\frac{2}{\pi}} \right\} \varphi(u) \,du \\ =& e^{- \gamma_1 \sqrt{\frac{2}{\pi}}} \left\{ \int_0^\infty \frac{1}{\sqrt{2\pi}} \exp\left[ -\frac12 u^2 + (\alpha_1 + \gamma_1)u \right] \,du \right. \\ & \left. + \int_{-\infty}^0 \frac{1}{\sqrt{2\pi}} \exp\left[ -\frac12 u^2 + (\alpha_1 - \gamma_1)u \right] \,du \right\} \end{aligned}\] 其中 \[\begin{aligned} -\frac12 u^2 + (\alpha_1 \pm \gamma_1)u =& -\frac12 [ u - (\alpha_1 \pm \gamma_1)]^2 + \frac12 (\alpha_1 \pm \gamma_1)^2 , \end{aligned}\] 所以 \[\begin{aligned} E e^{g(\varepsilon)} =& e^{- \gamma_1 \sqrt{\frac{2}{\pi}}} \left\{ e^{\frac12 (\alpha_1 + \gamma_1)^2} \int_0^\infty \frac{1}{\sqrt{2\pi}} \exp\left[ -\frac12 (u - (\alpha_1 + \gamma_1))^2 \right] \,du \right. \\ & \left. + e^{\frac12 (\alpha_1 - \gamma_1)^2} \int_{-\infty}^0 \frac{1}{\sqrt{2\pi}} \exp\left[ -\frac12 (u - (\alpha_1 - \gamma_1))^2 \right] \,du \right\} \\ =& e^{- \gamma_1 \sqrt{\frac{2}{\pi}}} \left\{ e^{\frac12 (\alpha_1 + \gamma_1)^2} \int_{-(\alpha_1 + \gamma_1)}^\infty \varphi(v) \,dv + e^{\frac12 (\alpha_1 - \gamma_1)^2} \int_{-\infty}^{-(\alpha_1 - \gamma_1)} \varphi(v) \,dv \right\} \\ =& e^{- \gamma_1 \sqrt{\frac{2}{\pi}}} \left\{ e^{\frac12 (\alpha_1 + \gamma_1)^2} [ 1 - \Phi(-(\alpha_1 + \gamma_1))] + e^{\frac12 (\alpha_1 - \gamma_1)^2} \Phi(-(\alpha_1 - \gamma_1)) \right\} \\ =& e^{- \gamma_1 \sqrt{\frac{2}{\pi}}} \left\{ e^{\frac12 (\gamma_1 + \alpha_1)^2} \Phi(\gamma_1 + \alpha_1) + e^{\frac12 (\gamma_1 - \alpha_1)^2} \Phi(\gamma_1 - \alpha_1) \right\} . \end{aligned}\] 其中\(\varphi(\cdot)\)和\(\Phi(\cdot)\)是标准正态分布的密度和分布函数。

于是,超前二步预测为 \[\begin{align} \hat\sigma_h^2(2) =& e^{\alpha_0} E e^{g(\varepsilon)} [\hat\sigma_h^2(1)]^{\beta_1} . \tag{21.6} \end{align}\]

超前三步: \[\begin{aligned} \sigma_{h+3}^2 = e^{\alpha_0} (\sigma_{h+2}^{2})^{\beta_1} e^{g(\varepsilon_{h+2})}, \end{aligned}\] 注意到\(F_h \subset F_{h+1}\), \(\sigma_{h+2}^2 \in F_{h+1}\), \(\varepsilon_{h+2}\)与\(F_{h+1}\)独立, 可得 \[\begin{align} \hat\sigma_h^2(3) =& e^{\alpha_0} E \left\{ (\sigma_{h+2}^2)^{\beta_1} e^{g(\varepsilon_{h+2})} | F_h \right\} \\ =& e^{\alpha_0} E \left\{ E\left[ (\sigma_{h+2}^2)^{\beta_1} e^{g(\varepsilon_{h+2})} | F_{h+1} \right] | F_h \right\} \\ =& e^{\alpha_0} E \left\{ (\sigma_{h+2}^2)^{\beta_1} E\left[ e^{g(\varepsilon_{h+2})} | F_{h+1} \right] | F_h \right\} \\ =& e^{\alpha_0} E[e^{g(\varepsilon)}] E \left\{ (\sigma_{h+2}^2)^{\beta_1} | F_h \right\} \\ =& e^{\alpha_0} E[e^{g(\varepsilon)}] E \left\{ e^{\alpha_0 \beta_1} (\sigma_{h+1}^2)^{\beta_1^2} e^{\beta_1 g(\varepsilon_{h+1})} | F_h \right\} \\ =& e^{\alpha_0(1 + \beta_1)} E[e^{g(\varepsilon)}] E[e^{\beta_1 g(\varepsilon)}] (\hat\sigma_{h}^2(1))^{\beta_1^2} . \tag{21.7} \end{align}\]

对\(\hat\sigma^2_h(j)\)可类似计算。

21.2 GJR-GARCH模型

GJR-GARCH模型是另一个能够反映杠杆效应的波动率模型, 参见(Glosten, Jagannathan, and Runkle 1993)和(Zakoian 1994)。 或称为TGARCH。 GJR-GARCH(\(m,s\))模型的形式为 \[\begin{align} \sigma_t^2 = \alpha_0 + \sum_{i=1}^m (\alpha_i + \gamma_i N_{t-i}) a_{t-i}^2 + \sum_{j=1}^s \beta_j \sigma_{t-j}^2 \tag{21.8} \end{align}\] 其中\(N_{t-i}\)是表示\(a_{t-i}<0\)的示性函数,即 \[\begin{aligned} N_{t-i} = \begin{cases} 1, & a_{t-i} < 0 \\ 0, & a_{t-i} \geq 0 \end{cases} \end{aligned}\] \(\alpha_i, \gamma_i, \beta_j\)是非负参数, 满足与GARCH模型类似的参数条件。

正的\(a_{t-i}\)对\(\sigma_t^2\)的影响为\(\alpha_i a_{t-i}^2\), 负的\(a_{t-i}\)对\(\sigma_t^2\)的影响为\((\alpha_i + \gamma_i) a_{t-i}^2\), 当\(\gamma_i>0\)时负的\(a_{t-i}\)影响较大。

模型用0作为\(a_{t-i}\)的门限, 还可以用其它实数值作为门限。 关于门限模型参见(Tsay 2010)第4章。

作为例子, 考虑从1999年1月4日到2010年8月20日的欧元对美元汇率的日对数收益率序列。

读入数据:

d.useu <- read_table(

"d-useu9910.txt",

col_types=cols(.default=col_double())

)

xts.useu <- with(d.useu,

xts(rate, make_date(year, mon, day)))

xts.useu.lnrtn <- diff(log(xts.useu))[-1,]*100用rugarch包建模:

library(rugarch)

spec2 <- ugarchspec(

mean.model = list(

armaOrder=c(0,0),

include.mean=TRUE ),

variance.model = list(

model = "gjrGARCH", # GJR-GARCH or TGARCH model

garchOrder = c(1,1) ) )

mod2ru <- ugarchfit(spec = spec2, data = xts.useu.lnrtn)

show(mod2ru)##

## *---------------------------------*

## * GARCH Model Fit *

## *---------------------------------*

##

## Conditional Variance Dynamics

## -----------------------------------

## GARCH Model : gjrGARCH(1,1)

## Mean Model : ARFIMA(0,0,0)

## Distribution : norm

##

## Optimal Parameters

## ------------------------------------

## Estimate Std. Error t value Pr(>|t|)

## mu 0.012262 0.010726 1.1432 0.252951

## omega 0.001274 0.000554 2.3013 0.021373

## alpha1 0.022402 0.004277 5.2373 0.000000

## beta1 0.968711 0.001779 544.4570 0.000000

## gamma1 0.012435 0.007027 1.7696 0.076789

##

## Robust Standard Errors:

## Estimate Std. Error t value Pr(>|t|)

## mu 0.012262 0.011704 1.0476 0.294800

## omega 0.001274 0.000620 2.0535 0.040021

## alpha1 0.022402 0.004777 4.6891 0.000003

## beta1 0.968711 0.000795 1219.2085 0.000000

## gamma1 0.012435 0.008047 1.5454 0.122258

##

## LogLikelihood : -2731.85

##

## Information Criteria

## ------------------------------------

##

## Akaike 1.8688

## Bayes 1.8790

## Shibata 1.8688

## Hannan-Quinn 1.8725

##

## Weighted Ljung-Box Test on Standardized Residuals

## ------------------------------------

## statistic p-value

## Lag[1] 0.2619 0.6088

## Lag[2*(p+q)+(p+q)-1][2] 0.3038 0.7936

## Lag[4*(p+q)+(p+q)-1][5] 3.3494 0.3469

## d.o.f=0

## H0 : No serial correlation

##

## Weighted Ljung-Box Test on Standardized Squared Residuals

## ------------------------------------

## statistic p-value

## Lag[1] 4.935 0.02632

## Lag[2*(p+q)+(p+q)-1][5] 7.136 0.04806

## Lag[4*(p+q)+(p+q)-1][9] 9.101 0.07748

## d.o.f=2

##

## Weighted ARCH LM Tests

## ------------------------------------

## Statistic Shape Scale P-Value

## ARCH Lag[3] 2.979 0.500 2.000 0.08435

## ARCH Lag[5] 3.239 1.440 1.667 0.25696

## ARCH Lag[7] 4.681 2.315 1.543 0.25882

##

## Nyblom stability test

## ------------------------------------

## Joint Statistic: 1.4726

## Individual Statistics:

## mu 0.20009

## omega 0.20231

## alpha1 0.06618

## beta1 0.08927

## gamma1 0.08316

##

## Asymptotic Critical Values (10% 5% 1%)

## Joint Statistic: 1.28 1.47 1.88

## Individual Statistic: 0.35 0.47 0.75

##

## Sign Bias Test

## ------------------------------------

## t-value prob sig

## Sign Bias 1.663 0.096368 *

## Negative Sign Bias 2.386 0.017101 **

## Positive Sign Bias 1.740 0.082025 *

## Joint Effect 12.898 0.004863 ***

##

##

## Adjusted Pearson Goodness-of-Fit Test:

## ------------------------------------

## group statistic p-value(g-1)

## 1 20 59.51 4.628e-06

## 2 30 70.40 2.676e-05

## 3 40 69.44 1.928e-03

## 4 50 81.46 2.454e-03

##

##

## Elapsed time : 0.19853估计的模型为 \[\begin{aligned} r_t =& 0.0123 + a_t, \quad a_t = \sigma_t \varepsilon_t, \quad \varepsilon_t \text{ i.i.d. N}(0,1) \\ \sigma_t^2 =& 0.0013 + (0.0224 + 0.0124 N_{t-1}) a_{t-1}^2 + 0.9687 \sigma_{t-1}^2, \end{aligned}\] 模型结果中mu不显著, 在0.05水平下gamma1也不显著, 说明杠杆效应不显著。 模型标准化残差的白噪声检验通过, 但标准化残差平方的白噪声检验没有通过, 所以模型效果不够好。 模型参数稳定性检验没有通过。 拟合优度检验没有通过。

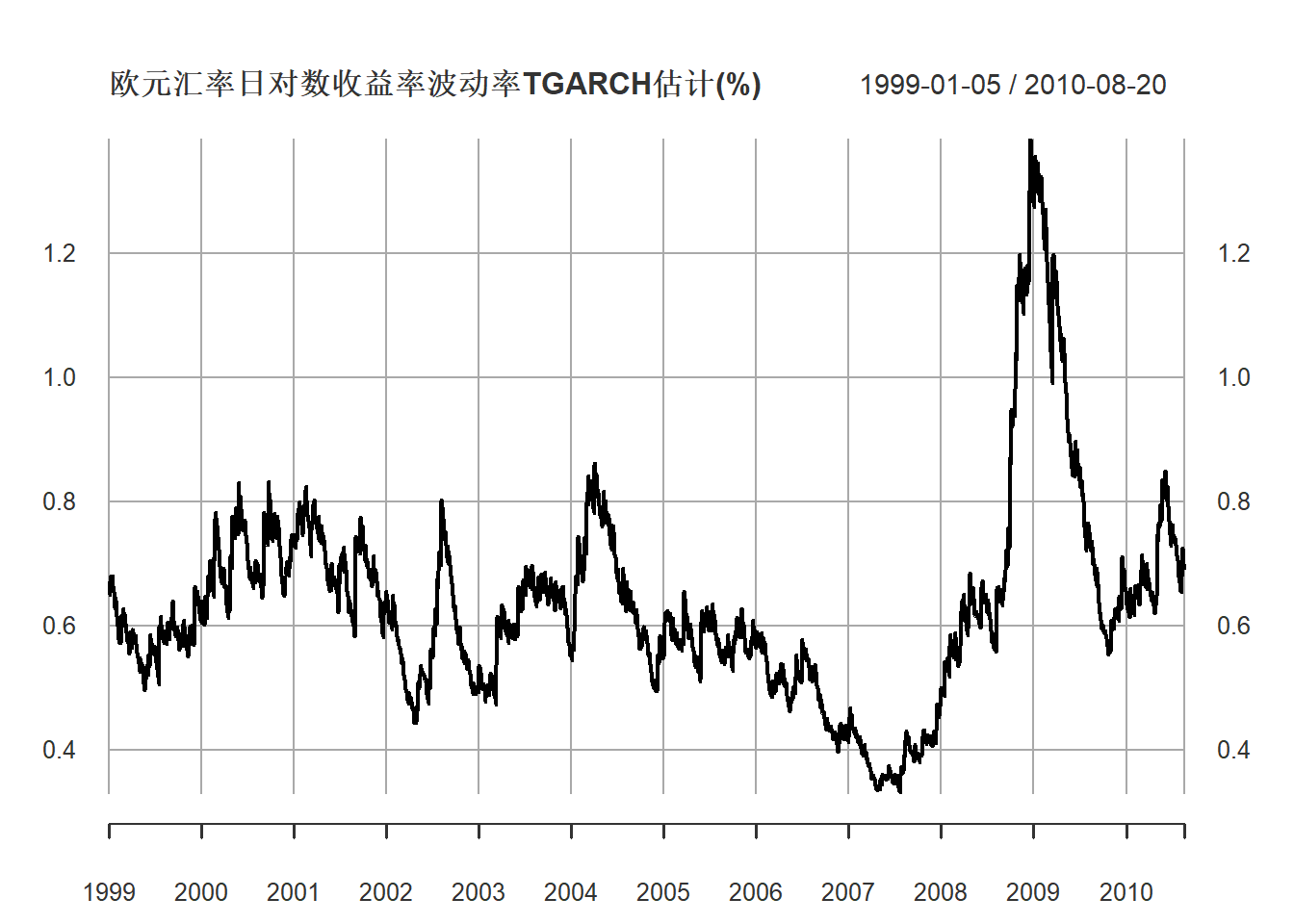

拟合的波动率\(\sigma_t\)序列图形(单位是百分之一):

plot(sigma(mod2ru),

format.labels="%Y",

main="欧元汇率日对数收益率波动率TGARCH估计(%)",

major.ticks="years", minor.ticks=NULL,

grid.ticks.on="years")

图21.8: 欧元汇率日对数收益率波动率TGARCH估计

波动率的最高值出现在2008年末、2009年初, 次贷危机爆发时期。

为了进行模型诊断,计算标准化残差:

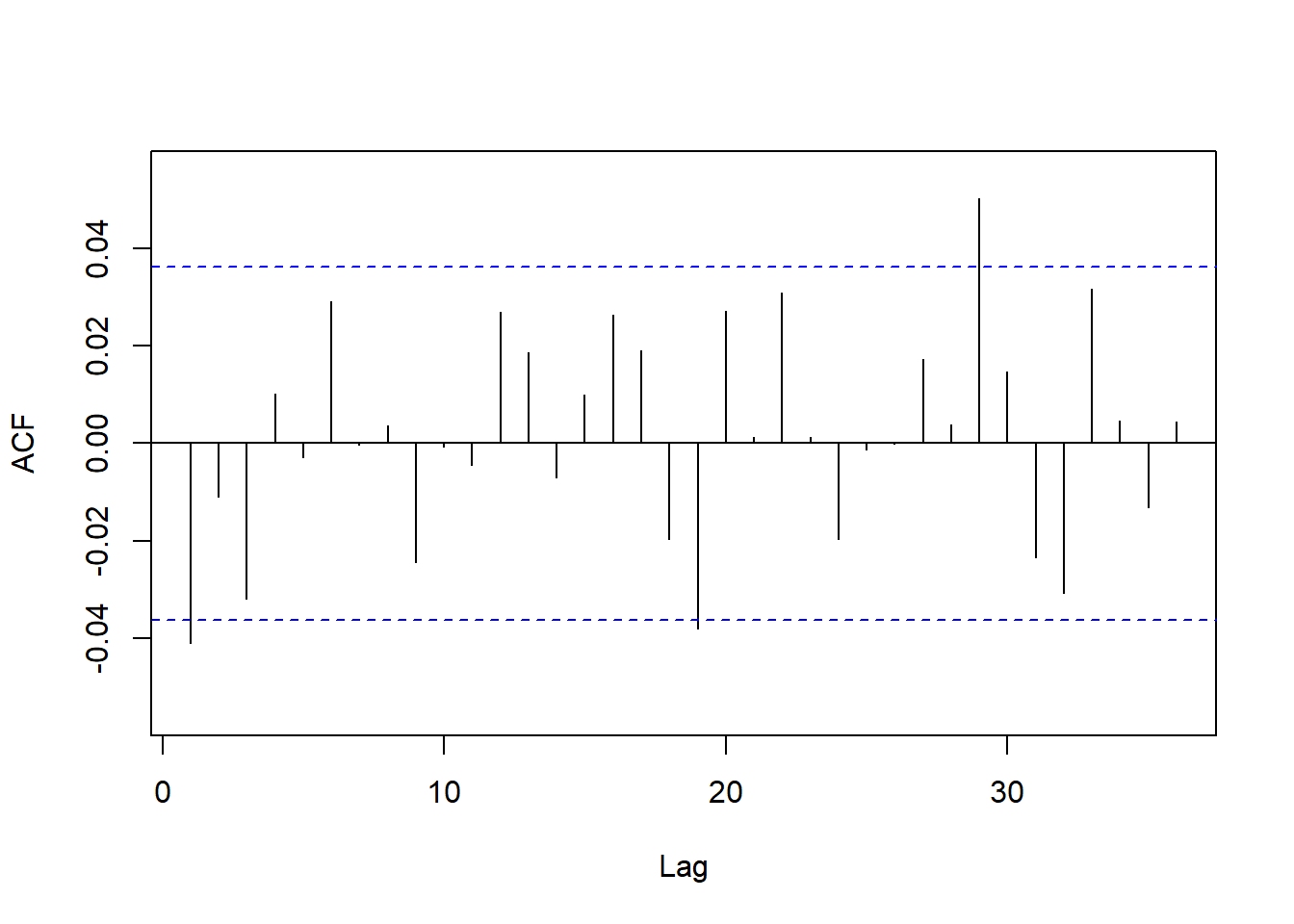

标准化残差的ACF:

图21.9: 欧元汇率日对数收益率TGARCH标准化残差ACF

标准化残差平方的ACF:

图21.10: 欧元汇率日对数收益率TGARCH标准化残差平方ACF

标准化残差的Ljung-Box白噪声检验:

##

## Box-Ljung test

##

## data: stdresi2

## X-squared = 15.029, df = 12, p-value = 0.2399标准化残差平方的Ljung-Box白噪声检验:

##

## Box-Ljung test

##

## data: stdresi2^2

## X-squared = 15.094, df = 12, p-value = 0.2363这些残差诊断的结果说明拟合的模型是基本符合的。

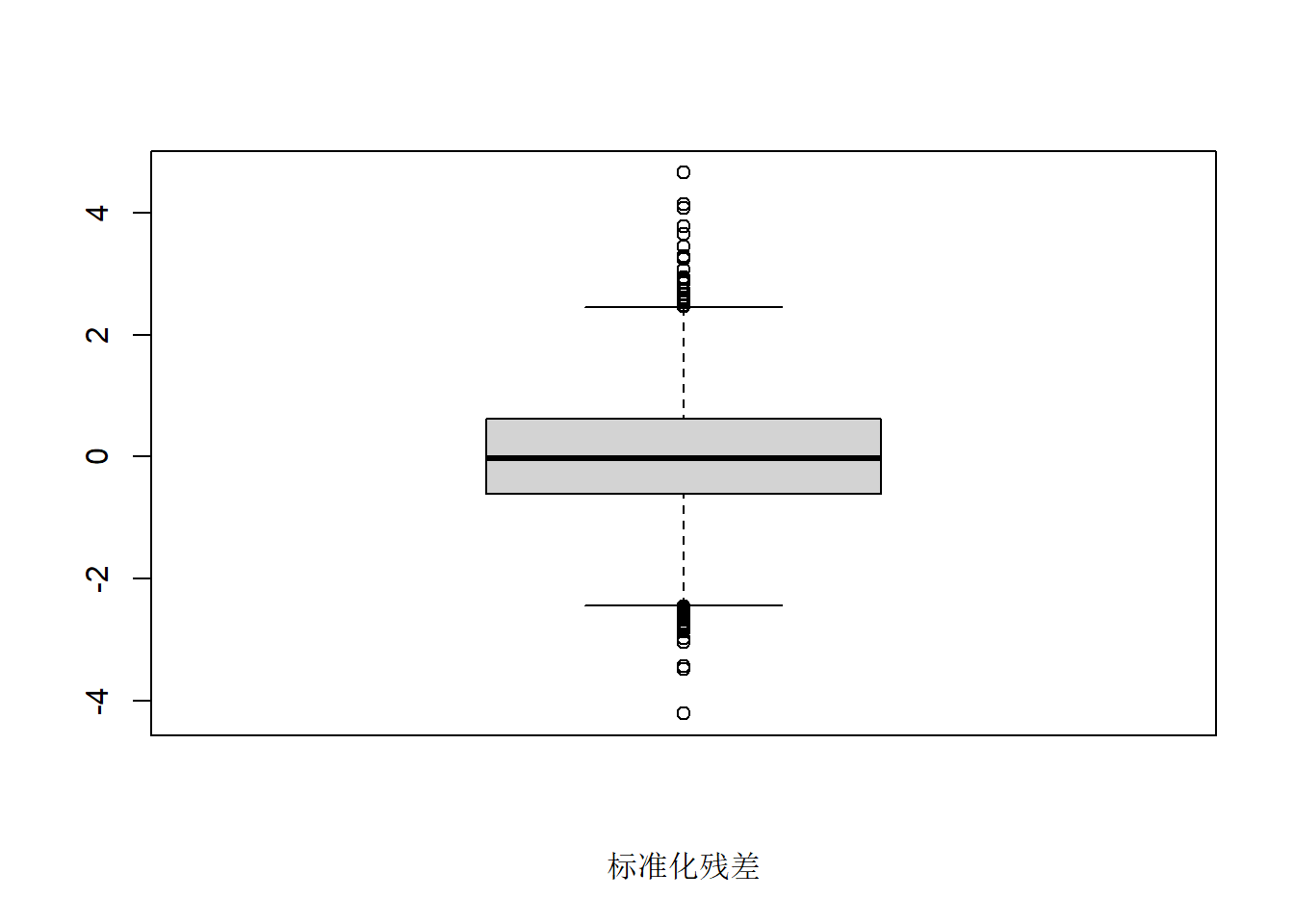

作标准化残差的盒形图:

图21.11: 欧元汇率日对数收益率TGARCH标准化残差盒形图

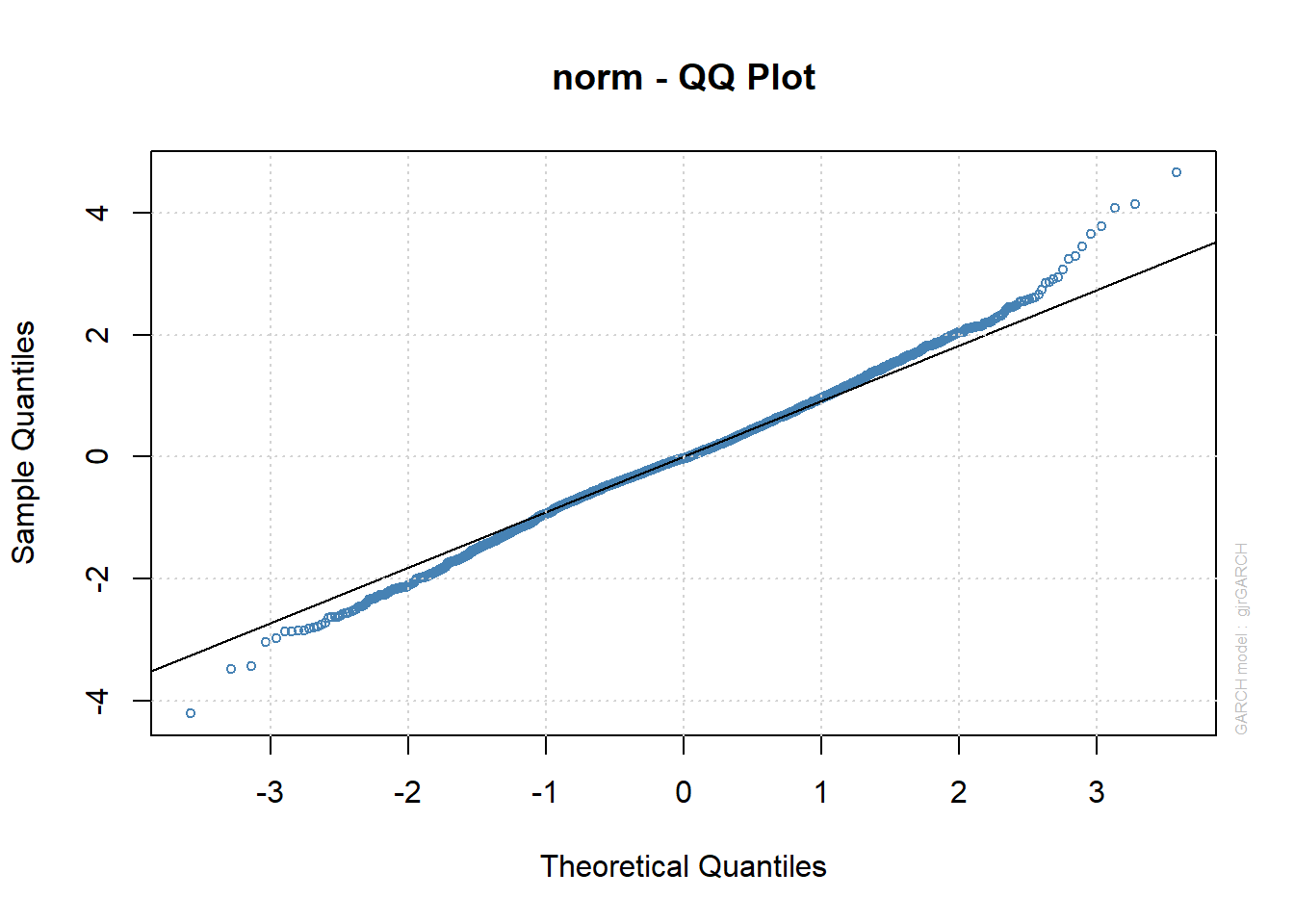

标准化残差的正态QQ图:

图21.12: 欧元汇率日对数收益率TGARCH标准化残差正态QQ图

从标准化残差的盒形图看有厚尾现象。

可以将GJR-GARCH得到的波动率与标准GARCH得到的波动率进行比较:

## NOTE: Packages 'fBasics', 'timeDate', and 'timeSeries' are no longer

## attached to the search() path when 'fGarch' is attached.

##

## If needed attach them yourself in your R script by e.g.,

## require("timeSeries")##

## Attaching package: 'fGarch'## The following object is masked from 'package:TTR':

##

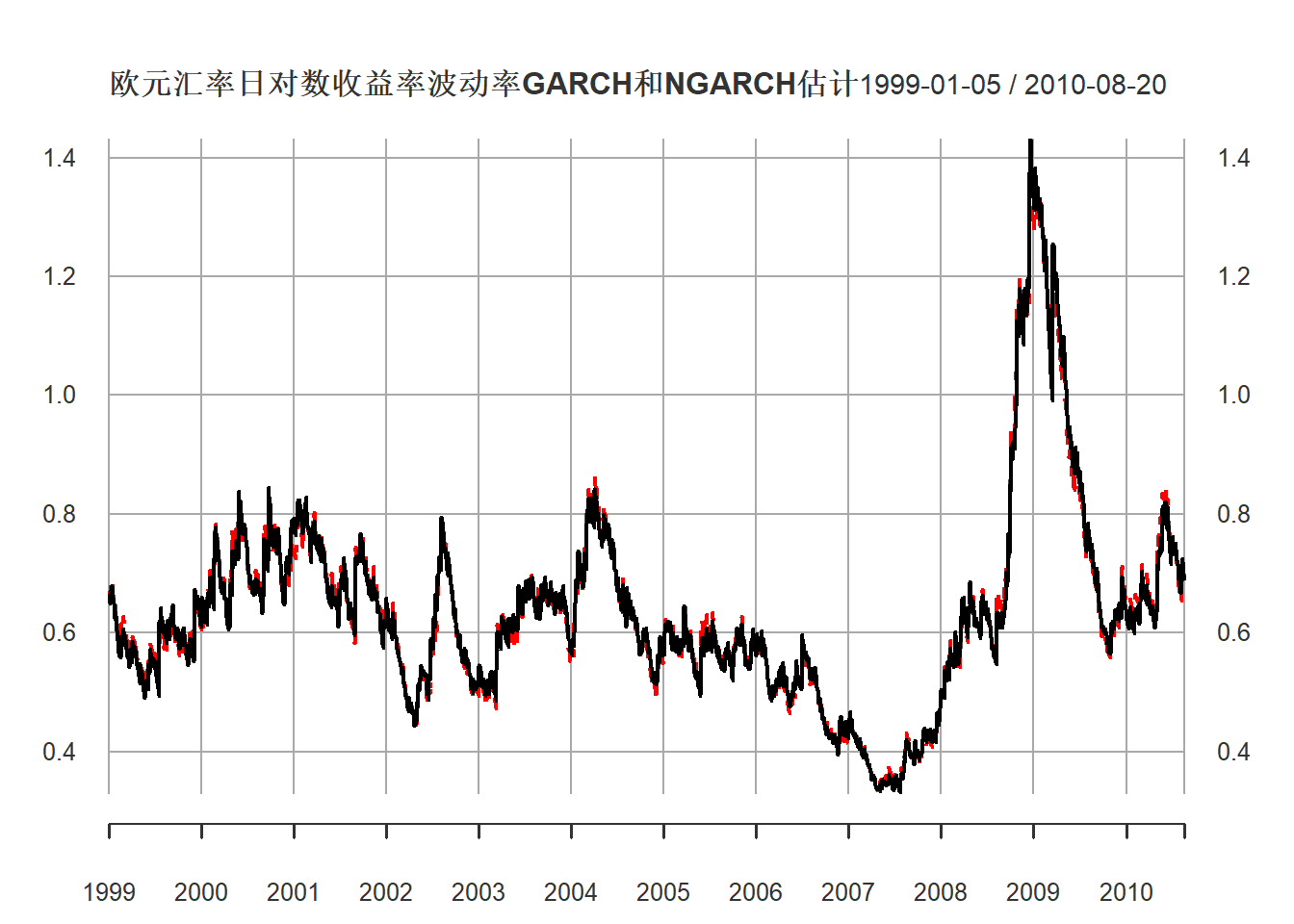

## volatility将两个波动率作图, 黑色为GARCH结果, 红色虚线为GJR-GARCH结果:

plot(cbind(volatility(mod2sg), sigma(mod2ru)),

main="欧元汇率日对数收益率波动率GARCH和NGARCH估计",

lty=c(1,2),

col=c("black", "red"),

format.labels="%Y",

major.ticks="years", minor.ticks=NULL,

grid.ticks.on="years")

图21.13: 欧元汇率GARCH和NGARCH估计的波动率

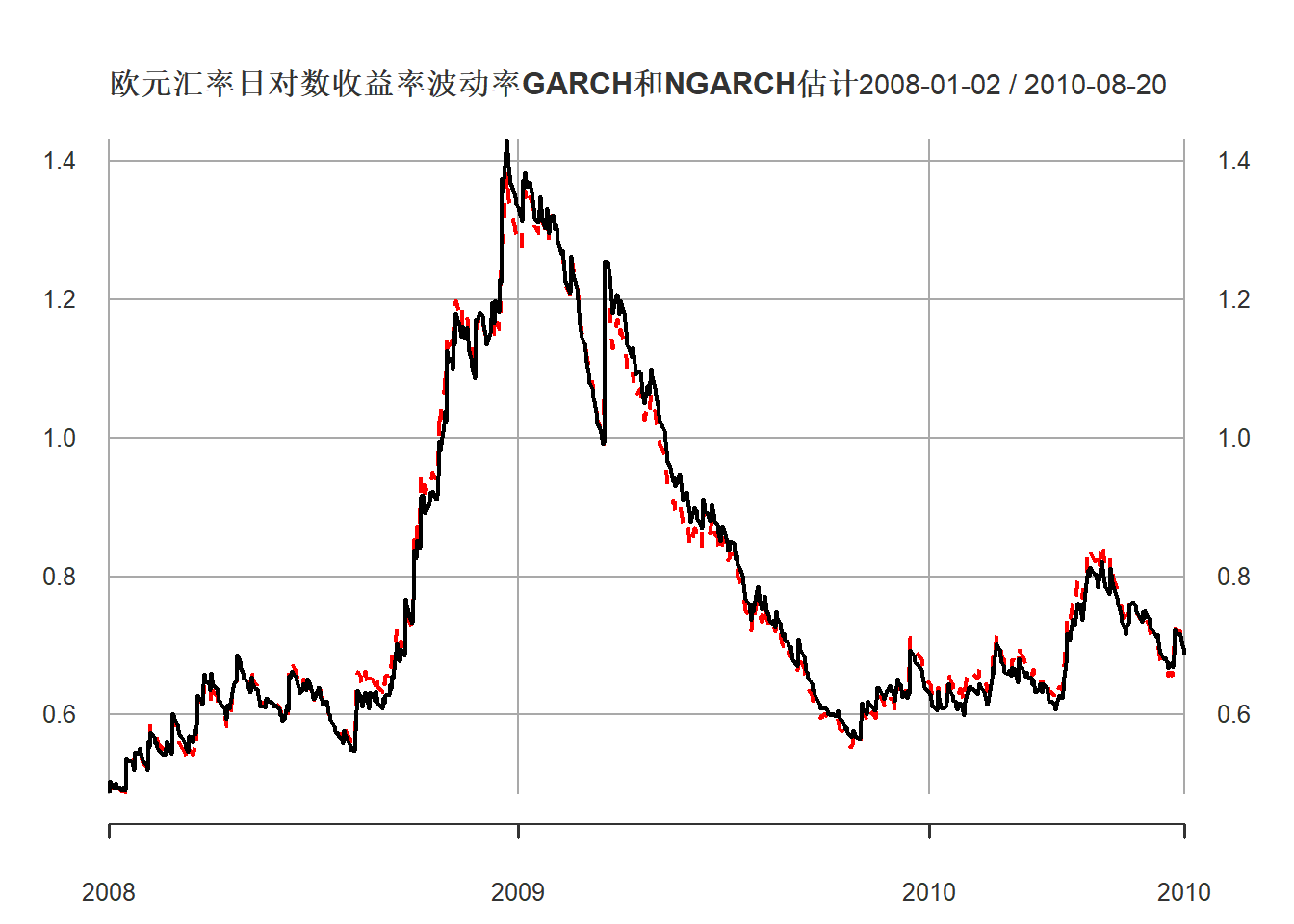

放大显示其中2008年以后:

plot(cbind(volatility(mod2sg), sigma(mod2ru)),

subset="2008/",

main="欧元汇率日对数收益率波动率GARCH和NGARCH估计",

lty=c(1,2),

col=c("black", "red"),

format.labels="%Y",

major.ticks="years", minor.ticks=NULL,

grid.ticks.on="years")

图21.14: 欧元汇率GARCH和NGARCH估计的波动率

21.3 APARCH模型

(Ding, Granger, and Engle 1993)提出了非对称幂(asymmetric power) ARCH模型(APARCH模型), 模型形式为 \[\begin{align} r_t =& \mu_t + a_t, \quad a_t = \sigma_t \varepsilon_t, \quad \varepsilon_t \sim D(0,1) \\ \sigma_t^\delta =& \omega + \sum_{i=1}^m \alpha_i (|a_{t-i}| - \gamma_i a_{t-i})^\delta + \sum_{j=1}^s \beta_j \sigma_{t-j}^\delta \tag{21.9} \end{align}\] 其中\(\mu_t\)是条件均值, \(D(0,1)\)表示某个零均值单位方差分布, \(\delta\)为正实数, 系数\(\omega, \alpha_i, \gamma_i, \beta_j\)满足某些正则性条件使得波动率为正。

最常用的是最简单的APARCH(1,1)模型。 这个模型中包含了许多其它模型。

当\(\delta=2\)且\(\gamma_j = 0\)时即普通的GARCH模型。

当\(\delta=2\)时即TGARCH模型(形式略有不同)。

当\(\delta=1\)时波动率方程直接使用波动率\(\sigma_{t}\)和新息\(a_t\)而非其平方。

APARCH中的幂变换旨在提高拟合程度, 但幂次\(\delta\)没有很好解释。

R的fGarch::garchFit()函数中可以使用aparch(m,s)作为模型设定。

作为例子,

拟合欧元对美元汇率数据:

library(fGarch, quietly = TRUE)

modres3 <- garchFit( ~ 1 + aparch(1,1),

data=xts.useu.lnrtn, trace=FALSE)

summary(modres3)##

## Title:

## GARCH Modelling

##

## Call:

## garchFit(formula = ~1 + aparch(1, 1), data = xts.useu.lnrtn,

## trace = FALSE)

##

## Mean and Variance Equation:

## data ~ 1 + aparch(1, 1)

## <environment: 0x000002d778b3d3d8>

## [data = xts.useu.lnrtn]

##

## Conditional Distribution:

## norm

##

## Coefficient(s):

## mu omega alpha1 gamma1 beta1 delta

## 0.0127647 0.0015919 0.0313680 0.1135334 0.9689155 1.6743075

##

## Std. Errors:

## based on Hessian

##

## Error Analysis:

## Estimate Std. Error t value Pr(>|t|)

## mu 0.0127647 0.0107626 1.186 0.2356

## omega 0.0015919 0.0007226 2.203 0.0276 *

## alpha1 0.0313680 0.0053350 5.880 4.11e-09 ***

## gamma1 0.1135334 0.0711911 1.595 0.1108

## beta1 0.9689155 0.0038405 252.292 < 2e-16 ***

## delta 1.6743075 0.4057124 4.127 3.68e-05 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Log Likelihood:

## -2731.172 normalized: -0.9324587

##

## Description:

## Tue May 21 15:25:28 2024 by user: Lenovo

##

##

## Standardised Residuals Tests:

## Statistic p-Value

## Jarque-Bera Test R Chi^2 50.20526 1.253331e-11

## Shapiro-Wilk Test R W 0.9956711 1.608388e-07

## Ljung-Box Test R Q(10) 13.37689 0.2033562

## Ljung-Box Test R Q(15) 20.19634 0.1645295

## Ljung-Box Test R Q(20) 22.84736 0.2963514

## Ljung-Box Test R^2 Q(10) 13.15611 0.2150739

## Ljung-Box Test R^2 Q(15) 16.58008 0.34458

## Ljung-Box Test R^2 Q(20) 27.44887 0.1231012

## LM Arch Test R TR^2 14.35739 0.2784708

##

## Information Criterion Statistics:

## AIC BIC SIC HQIC

## 1.869014 1.881269 1.869006 1.873428拟合的白噪声检验说明模型是充分的, 但是\(\delta\)的估计为1.67, 标准误差为0.41, 其95%置信区间为\((0.85, 2.49)\)包含2, 所以与\(\delta=2\)没有显著差异, 可以用TGARCH模型。 \(\gamma_1\)在0.05水平下不显著, 可以不需要反映杠杆效应的模型。

拟合的APARCH模型为: \[\begin{aligned} r_t =& 0.0128 + a_t, \quad a_t = \sigma_t \varepsilon_t, \quad \varepsilon_t \sim \text{N}(0,1) \\ \sigma_t^{1.67} =& 0.0016 + 0.0313 (|a_{t-1}| - 0.1135 a_{t-1})^{1.67} + 0.9689 \sigma_{t-1}^{1.67} \end{aligned}\]

固定\(\delta=2\)估计APARCH(1,1)模型:

modres4 <- garchFit( ~ 1 + aparch(1,1),

data=xts.useu.lnrtn, delta=2,

include.delta=FALSE, trace=FALSE)

summary(modres4)##

## Title:

## GARCH Modelling

##

## Call:

## garchFit(formula = ~1 + aparch(1, 1), data = xts.useu.lnrtn,

## delta = 2, include.delta = FALSE, trace = FALSE)

##

## Mean and Variance Equation:

## data ~ 1 + aparch(1, 1)

## <environment: 0x000002d77de83080>

## [data = xts.useu.lnrtn]

##

## Conditional Distribution:

## norm

##

## Coefficient(s):

## mu omega alpha1 gamma1 beta1

## 0.0122646 0.0012745 0.0282723 0.1100242 0.9687115

##

## Std. Errors:

## based on Hessian

##

## Error Analysis:

## Estimate Std. Error t value Pr(>|t|)

## mu 0.0122646 0.0107289 1.143 0.2530

## omega 0.0012745 0.0005752 2.216 0.0267 *

## alpha1 0.0282723 0.0038637 7.317 2.53e-13 ***

## gamma1 0.1100242 0.0649051 1.695 0.0900 .

## beta1 0.9687115 0.0039421 245.735 < 2e-16 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Log Likelihood:

## -2731.85 normalized: -0.9326902

##

## Description:

## Tue May 21 15:25:29 2024 by user: Lenovo

##

##

## Standardised Residuals Tests:

## Statistic p-Value

## Jarque-Bera Test R Chi^2 49.97677 1.405021e-11

## Shapiro-Wilk Test R W 0.9956803 1.655881e-07

## Ljung-Box Test R Q(10) 13.38285 0.2030469

## Ljung-Box Test R Q(15) 20.29833 0.1607845

## Ljung-Box Test R Q(20) 22.87265 0.2950907

## Ljung-Box Test R^2 Q(10) 12.89586 0.2295531

## Ljung-Box Test R^2 Q(15) 16.55288 0.3462876

## Ljung-Box Test R^2 Q(20) 27.24036 0.128636

## LM Arch Test R TR^2 14.29661 0.2821695

##

## Information Criterion Statistics:

## AIC BIC SIC HQIC

## 1.868795 1.879007 1.868789 1.872472拟合的固定\(\delta=2\)的APARCH模型为: \[\begin{aligned} r_t =& 0.0123 + a_t, \quad a_t = \sigma_t \varepsilon_t, \quad \varepsilon_t \sim \text{N}(0,1) \\ \sigma_t^2 =& 0.00127 + 0.0283 (|a_{t-1}| - 0.1100 a_{t-1})^2 + 0.9687 \sigma_{t-1}^2 \end{aligned}\] 其中的波动率方程可以借助\(N_{t-1}\)为\(a_{t-1}<0\)的示性函数写成 \[ \sigma_t^2 = 0.00127 + (0.0224 + 0.0125 N_{t-1}) a_{t-1}^2 + 0.9687 \sigma_{t-1}^2 . \]

与直接估计TGARCH(1,1)的结果对比: \[\begin{aligned} r_t =& 0.0123 + a_t, \quad a_t = \sigma_t \varepsilon_t, \quad \varepsilon_t \text{ i.i.d. N}(0,1) \\ \sigma_t^2 =& 0.0013 + (0.0224 + 0.0124 N_{t-1}) a_{t-1}^2 + 0.9687 \sigma_{t-1}^2 . \end{aligned}\] 两个估计结果基本相同。

也可以用rugarch包估计APARCH模型:

library(rugarch)

spec3 <- ugarchspec(

mean.model = list(

armaOrder=c(0,0),

include.mean=TRUE ),

variance.model = list(

model = "apARCH", # APARCH model

garchOrder = c(1,1) ) )

mod3ru <- ugarchfit(spec = spec3,

data = xts.useu.lnrtn)

show(mod3ru)##

## *---------------------------------*

## * GARCH Model Fit *

## *---------------------------------*

##

## Conditional Variance Dynamics

## -----------------------------------

## GARCH Model : apARCH(1,1)

## Mean Model : ARFIMA(0,0,0)

## Distribution : norm

##

## Optimal Parameters

## ------------------------------------

## Estimate Std. Error t value Pr(>|t|)

## mu 0.012516 0.010740 1.1654 0.243858

## omega 0.001683 0.000595 2.8299 0.004656

## alpha1 0.031692 0.000877 36.1495 0.000000

## beta1 0.969388 0.000679 1427.5230 0.000000

## gamma1 0.121817 0.072545 1.6792 0.093115

## delta 1.580101 0.129609 12.1913 0.000000

##

## Robust Standard Errors:

## Estimate Std. Error t value Pr(>|t|)

## mu 0.012516 0.011800 1.0607 0.288841

## omega 0.001683 0.000772 2.1804 0.029229

## alpha1 0.031692 0.002833 11.1859 0.000000

## beta1 0.969388 0.000680 1425.6414 0.000000

## gamma1 0.121817 0.084847 1.4357 0.151084

## delta 1.580101 0.082927 19.0542 0.000000

##

## LogLikelihood : -2731.113

##

## Information Criteria

## ------------------------------------

##

## Akaike 1.8690

## Bayes 1.8812

## Shibata 1.8690

## Hannan-Quinn 1.8734

##

## Weighted Ljung-Box Test on Standardized Residuals

## ------------------------------------

## statistic p-value

## Lag[1] 0.2823 0.5952

## Lag[2*(p+q)+(p+q)-1][2] 0.3207 0.7843

## Lag[4*(p+q)+(p+q)-1][5] 3.3970 0.3393

## d.o.f=0

## H0 : No serial correlation

##

## Weighted Ljung-Box Test on Standardized Squared Residuals

## ------------------------------------

## statistic p-value

## Lag[1] 5.165 0.02304

## Lag[2*(p+q)+(p+q)-1][5] 7.349 0.04264

## Lag[4*(p+q)+(p+q)-1][9] 9.341 0.06909

## d.o.f=2

##

## Weighted ARCH LM Tests

## ------------------------------------

## Statistic Shape Scale P-Value

## ARCH Lag[3] 2.896 0.500 2.000 0.08882

## ARCH Lag[5] 3.238 1.440 1.667 0.25703

## ARCH Lag[7] 4.723 2.315 1.543 0.25404

##

## Nyblom stability test

## ------------------------------------

## Joint Statistic: 1.5207

## Individual Statistics:

## mu 0.18789

## omega 0.18056

## alpha1 0.07682

## beta1 0.09516

## gamma1 0.38035

## delta 0.08651

##

## Asymptotic Critical Values (10% 5% 1%)

## Joint Statistic: 1.49 1.68 2.12

## Individual Statistic: 0.35 0.47 0.75

##

## Sign Bias Test

## ------------------------------------

## t-value prob sig

## Sign Bias 1.641 0.100814

## Negative Sign Bias 2.398 0.016537 **

## Positive Sign Bias 1.771 0.076666 *

## Joint Effect 12.991 0.004657 ***

##

##

## Adjusted Pearson Goodness-of-Fit Test:

## ------------------------------------

## group statistic p-value(g-1)

## 1 20 62.92 1.323e-06

## 2 30 71.22 2.064e-05

## 3 40 73.65 6.628e-04

## 4 50 79.79 3.561e-03

##

##

## Elapsed time : 0.5444798与fGarch包的估计结果不完全相同, 参数值比较接近。